Tsp annuity calculator

This calculator was designed by Frank Cullen a retired FAA manager. This is known as the accumulation phase.

Tsp Calculator Shop 53 Off Www Wtashows Com

The structure of the FERS retirement annuity is designed to encourage employees to continue working in the Federal service.

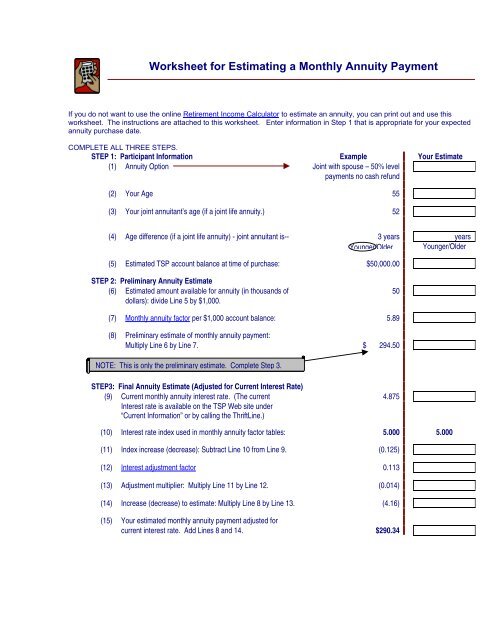

. A fixed deferred annuity consists of two distinct phases. Use the TSP Annuity Calculator on the Web site to estimate what your monthly annuity payments might be. TSP monthly payments and a life annuity.

Projected Annuity Calculator Excel Form The column reserved for your projected annuity with survivor benefits will be slightly lower since the maximum spousal benefit is 50 for FERS not the 55 for CSRS. Your employer will provide you with information about your withdrawal options and the option to keep your money in the TSP. Refer to TSPs website for the Historical Annuity Rate Index factors.

The option you may pick a full withdrawal would be conducted using TSP-70 form or you may choose a partial TSP withdrawal. Also the full FERS annuity will cost the retiree a little more because FERS employees pay 10 of their annuity for a full survivors benefit where CSRS pay just under 10. An unpaid TSP loan may delay disbursement of the TSP account balance.

FERS COLAs are also weighted and adjusted down when the COLA exceeds 2. During this phase the current interest rate is applied. Employees who have under 20 years of service receive an annuity calculated at one-quarter of such amount.

Also the full FERS annuity will cost the retiree a. Many seniors prefer this reliability to the volatility of the stock market. The non-TSP savings amount that you entered may include savings from different sources such as your savings accounts non-TSP mutual funds and non-TSP retirement funds private sector 401-Ks Individual Retirement Accounts etc.

Federal Annuity Calculation for LEOs. OPMs Federal Ballpark Estimate - Annuity TSP projections. To estimate your monthly TSP annuity payment you can use an online calculator or download a worksheet.

The FERS Retirement Annuity. We assume that the contribution limits for your retirement accounts increase with inflation. It is important to compare annuities to find the one that best fits your needs and goals.

Social Security and your TSP. Retirement Planning Videos Bank Rates Menu Toggle. The FERS Retirement Annuity.

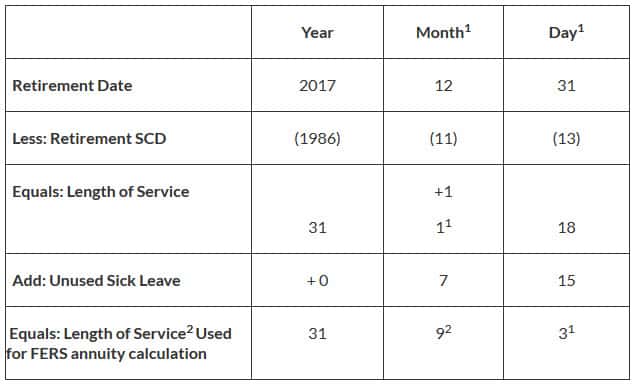

1 OPM uses a 30 day a month 12-month a year calendar. Many federal employees believe there is an early withdrawal penalty for taking anything out of the TSP before reaching age 59 ½ but this isnt true. The structure of the FERS retirement annuity is designed to encourage employees to continue working in the Federal service.

Find out the soonest possible date you can retire from Federal service and still receive an retirement annuity. It was established by Congress in the Federal Employees Retirement System Act of 1986 and offers the same types of savings and tax benefits that many private corporations offer their employees. The following chart may be used to determine a FERS employees length of service to calculate FERS retirement annuity.

We assume you will live to 95. The lower of these two balances will be used in the CSRS annuity component calculation while the difference of the two balances will be used in the FERS annuity calculation. The key question that will likely determine your selection.

The amount of your monthly annuity payments depends to a large degree on the size of your TSP account balance or the portion of your account that you. Employees who have under 20 years of service receive an annuity calculated at one-quarter of such amount. How Will the COLA of 2023 Affect Your Annuity If You Retire in 2022.

The payments arent subject to the additional 10 tax on early distributions even if you are under age 55 when they begin. If you ask the TSP to buy an annuity with the money in your account from traditional contributions and earnings the annuity payments are taxed when you receive them. We stop the analysis there regardless of your spouses age.

Your employer will provide you with information about your withdrawal options and the option to keep your money in the TSP. TSP Investors Handbook New 7th Edition. Indexed annuities perform well when the financial markets perform well.

Use the convenient Tax Calculator listed below to determine how much federal tax you will pay each month. We automatically distribute your savings optimally among different retirement accounts. The best type of annuity varies from person to person.

If you choose not to withdraw your funds in the event of your death the TSP Service Office would pay the funds based on your written designation form. My Account Plan Participation Investment Funds Planning and Tools Life Events and. One of the options you have when you use the TSP withdrawal calculator available through the Thrift Savings Plan website is to better understand what TSP Annuity options are available to you.

An unpaid TSP loan may delay disbursement of the TSP account balance. After you decide to buy a fixed deferred annuity the insurance company sets an agreement to pay you a minimum rate of interest when your account is growing. This TSP calculator will help you decide whether receiving monthly income is right for you by comparing the available options and features that might meet.

A financial advisor will be able to help you calculate the amount required to fund the income you desire. It is based on 11 percent of high-3 average times years of service or fractions thereof. If your annuity started after November 18 1996 you must use the Simplified Method to figure the taxable and tax-free parts of your annuity.

An indexed annuity also known as a fixed-index or equity-indexed annuity features income payments tied to a stock index such as the SP 500. Those wondering how to calculate their 2023 COLA should consider numerous factors like the retirement system that applies to them how many months since they started receiving retirement payments in the previous year their age and whether they are eligible for FERS special. Calculate your FERS CSRS and TSP estimates or run an exact High-3 calculation Military Deposit Social Security estimate and more.

If you choose not to withdraw your funds in the event of your death the TSP Service Office would pay the funds based on your written designation form. It is based on 11 percent of high-3 average times years of service or fractions thereof. You should consider how you wish to pay for an annuity the.

The type of annuity that is best suited for you depends on your current financial situation and long-term financial goals for an annuity. CSRS Annuity Calculator Includes early retirement deposits redeposits life insurance. If you want monthly income from your TSP account when you separate from federal service you have two options.

The TSP has calculator features that can give you a hand in projecting TSP balances and the size of your TSP. Forgot your account number or user ID. Calculating an Annuity FERS CSRS.

The Thrift Savings Plan TSP is a retirement savings and investment plan for Federal employees and members of the uniformed services including the Ready Reserve. How To Calculate A FERS Annuity Step 1. Once you know how much youll need you can enter your data into our immediate annuity calculator to get an estimated monthly income figure.

TSP Payment and Annuity Calculator. FERS annuities are based on high-3 average pay which is the highest average basic pay youve earned during any three.

Tsp Calculator Shop 53 Off Www Wtashows Com

2

Your High Three Estimate In Our Fers Calculator Retirement Benefits Instituteretirement Benefits Institute

2

Tsp Calculator Shop 53 Off Www Wtashows Com

Fers Retirement Calculator How To Calculate The Fers Basic Annuity

Fers Retirement Calculator How To Calculate The Fers Basic Annuity

Tsp Calculator Shop 53 Off Www Wtashows Com

Tailoring A Tsp Annuity

Tsp Calculator Shop 53 Off Www Wtashows Com

Tsp Calculator Shop 53 Off Www Wtashows Com

Tsp Annuity Cola Calculation To Change In March

Tsp Calculator Best Sale 57 Off Www Wtashows Com

Tsp Calculator Shop 53 Off Www Wtashows Com

Installments Vs Annuity Using Your Tsp For Regular Income

The Definitive List Of Annuity Questions The Annuity Expert

Federal Retirement Calculator Fers Csrs My Federal Retirement